Freelance company formation Netherlands : BV + 30% ruling or ZZP/eenmanszaak?

Dec 5, 2025

The Netherlands is an excellent place to set up your business as a freelancer, and serve clients from all over the world. But freelancing also means going into business, and that means making some business choices. In this article we will zoom into the difference between either the ZZP/Eenmanszaak or the BV + 30% ruling setup.

When setting up a Dutch BV, you enter into its employment as a director. This employment situation offers the unique possibility of applying for a 30% ruling in your own BV. This article will focus specifically on the lucky birds that are eligible for that, in comparison to the regular eenmanszaak/ZZP setup. Another article goes deeper into the differences between BV and ZZP/Eenmanszaak, with the 30% ruling taken out of the equation. Yet another article combines all practical questions about freelancing in the Netherlands in one FAQ.

Tax comparison between BV + 30% and ZZP/Eenmanszaak

The main point of contention is the amount of post-tax earnings you take away when using either company form. This requires some further zooming into the details. The ZZP/Eenmanszaak comes with some considerable tax advantages, especially for starters. The “Zelfstandigenaftrek” , “Startersaftrek” and “MKB Winstvrijstelling” can easily add up to € 10,000 - € 15,000 per year in tax free income. But there is a very big but: you must meet the tax requirements for that. These are the rules in a nutshell:

- spend at least 1224 hours per year in your EZ

- have 3 or more clients

- don’t have more than 70% revenues from one single client

- promote your business, for example using a website

- If you work intensively for one client, use correct freelance agreements.

- Make sure your work does not resemble the work of regular employees in your client’s company (for example: don’t lead or direct other employees, keep freedom in how to perform your work, what times and from where).

€ 69,000 profits per year in a ZZP/Eenmanszaak yields € 50,972 post tax salary. Source: Standard ZZP salary calculator on internet.

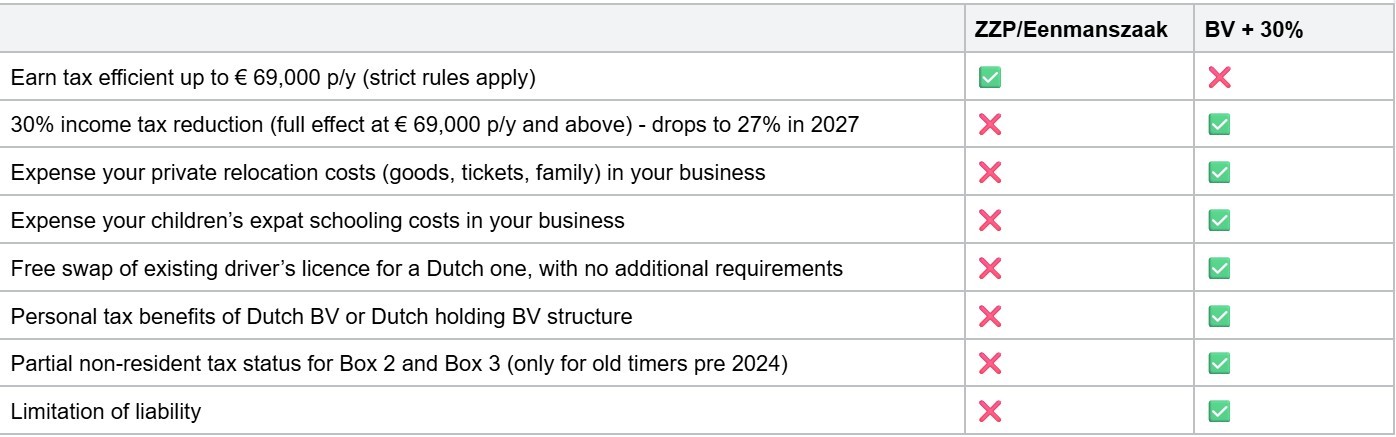

If you don’t meet these criteria, you cannot apply the tax breaks and the ZZP/eenmanszaak tax treatment will become the same as that of regular employment, which is even less attractive than a BV without 30% ruling. If you meet the above criteria, you can take the following rule of thumb: if you earn € 69,000 per year in your company, the BV + 30% is more tax efficient than ZZP/eenmanszaak. If you go below € 69,000, the 30% ruling does not have full effect so its advantages quickly diminish and the ZZP/Eenmanszaak becomes more tax efficient at around the € 65,000 mark. See the calculations above and below for rough indications of post tax salary take-aways.

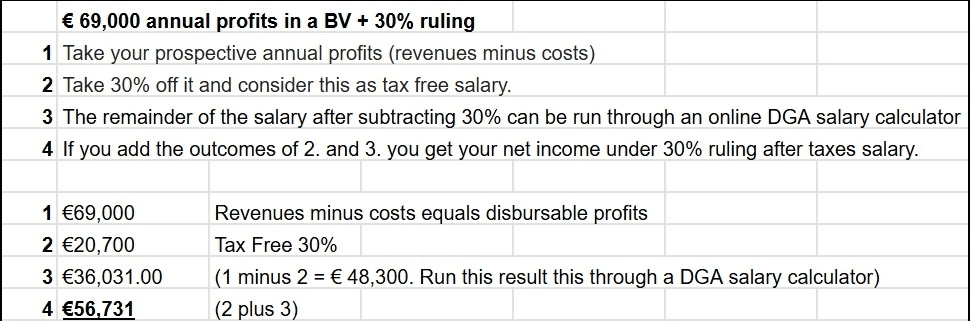

€ 69,000 profits per year in a BV+30% yields € 56,731 post tax salary. Standard DGA salary calculator on internet.

NB: The ZZP/Eenmanszaak post tax income will not stay the same over the course of a 5 year period. It will lose the the so-called “startersaftrek” and the “zelfstandigenaftrek” will be further dressed down. The ZZP/Eenmanszaak is under very heavy political scrutiny because of its preferential tax status over regular employees, and how it’s being abused by persons who by all acounts and means should be taxed as regular employees (so called schijnzelfstandigheid or “bogus self employment”). Obligatory insurance and winding down of tax benefits are to be expected for the ZZP/eenmanszaak company form in the coming years.

Accounting costs in a BV+30% ruling setup versus ZZP/Eenmanszaak

Setting up a Dutch company will result in certain tax and accounting obligations. While it is true that accounting obligations in a Dutch BV are more numerous than in a ZZP/eenmanszaak, you are going to need an accountant either way if you don’t speak Dutch. Our partners at 100digital offer English speaking accounting services for less than € 200 exc. VAT per month.

Relocation cost expensing in your new Dutch company

As outlined above, working from a Dutch BV means you will be appointed as its director. This is an employment relationship. Dutch employment law allows for Dutch companies to reimburse their employees for their relocation costs, when these costs are incurred as a requirement for the execution of their jobs. If you are fresh to the Netherlands and you do everything in the right sequence, your travels to the Netherlands to begin your work as director of your Dutch company will fall under this rule. The costs covered here include: the costs for relocating your household goods, plane tickets for yourself and your direct family members. The costs are reimbursed as a forfetairy fixed amount of up to € 7,750.

How can you make this work for yourself ? Make sure you let your BV company hire yourself in your company while you are still abroad, so that your relocation to the Netherlands is required as part of the execution of your work for your BV company. Also make sure your DGA labour contract contains the appropriate clause for this cost compensation. It’s that simple. Just make sure you set up your company and sign your labor contract with your company while still abroad. Coincidentally this is also exactly what is required for the BV + 30% ruling setup.

Availability: This perk is only available when you set up a BV, not an eenmanszaak/ZZP. The 30% ruling is not required for this.

Expense of schooling costs in your Dutch company

The previous two tax breaks are available to any and all employees of Dutch companies. But there is also another tax break that is only available to recipients of the 30% ruling : a compensation of your children’s schooling costs at an expat school in the Netherlands.

How can you make this work for yourself? Make sure your DGA labour contract contains the appropriate clause for this cost compensation. And make sure the schooling takes place at specialized expat school in the Netherlands (not a regular one). Make sure you collect and file the receipts in your company’s accounts.

Availability: This perk is only available if you have a BV and a 30% ruling, not in any other kind of setup.

Free driver’s license swap

Holders of the 30% ruling are also allowed to swap their foreign driver’s licence for a Dutch driver’s licence. The only downside here is that you have to wait until the final verdict of your 30% ruling, while the 30% ruling itself can already be applied from the start of your employment without having to wait for the final verdict. Just make an appointment at your Dutch “gemeente”, present your 30% ruling and your foreign driver’s licence, and all will be arranged.

Availability: This perk is only available if you have a BV and a 30% ruling, not in any other kind of setup.

Partial non-Residence tax status

When you work and live in the Netherlands, you are subjected to three pillars of taxation : labour income taxation (called “BOX 1”), major shareholdings (>5%) taxation (called “BOX 2” ) and generic asset taxation, including minor shareholdings, crypto savings and such (called “BOX 3”). If you work in the Netherlands, and you have assets in foreign countries, you need to declare those as part of your BOX 2 and BOX 3 income tax returns. Now, declaring them doesn’t mean you are actually going to be taxed over it, because in many cases a double-taxation treaty with the other country will prevent this. But still, the chance remains the Dutch Tax Authorities may take a bite out of it.

Holders of the 30% ruling have the option to apply for “partial non-residence” status for BOX 2 and BOX 3. This effectively means they don’t have to declare any of their foreign assets in their yearly BOX 2 and BOX 3 tax returns, which eliminates any chance the Dutch Tax Authorities lay any claim on their assets. But beware : 30% ruling holders from 2024 and onwards will have their partial non-resident status abolished effective 2025. Earlier 30% ruling holders will be able to continue using it until the end of 2026.

Availability: This perk is only available for 30% ruling holders who have had it since before 2024. The partial non-residence tax status will be revoked for them per 2027 as well.

BV or Holding Company Benefits

Working from a Dutch BV or Dutch BV plus Holding BV structure yields additional benefits over working from a ZZP/eenmanszaak. A single Dutch BV can be set up to have holding activities in addition to its operating activities. These holding activities then allow the BV to be used to hold profits for other use than immediate disbursement as salary or dividend. These other uses include : personal financing (mortgages, loans) or reinvestments into other ventures. If you are looking to participate in other businesses, either inside the Netherlands or abroad, the Dutch BV offers the attractive tax rule of participation exemption (“Deelnemingsvrijstelling” in Dutch). This is a rule against double-taxation. This means any dividends or sale price received on shares held will not be subject to dividend taxation, as profits have already been taxed in the subsidiary. So if after a few years of entrepreneurship you sell your stake in a company you invested in (or your own company for that matter), please make sure you do so from a holding BV company (NB: the participation exemption only applies if holding holds at least 5% of the shares in the subsidiary company).

Availability: This perk is only available if you have a BV, not in any other kind of setup. The 30% ruling is not required for this.

Limitation of liability

Going into business inherently entails taking business risk. As a freelance contractor or business owner you have an obligation to deliver correctly and in a timely manner. If you don’t, then as a rule you could be held liable for the consequences. In that respect, it’s important to realize that the ZZP/Eenmanszaak company form does not come with a separate legal identity and therefore does not limit your liability in any way. This means any claims resulting from your business activities can end up on your personal assets. If you work from a Dutch BV, however, your personal assets will be shielded off by the BVs limitation of liability. Any business claims will land solely on the BV’s doormat, not yours personally.

Availability: This perk is only available if you have a BV, not in any other kind of setup. The 30% ruling is not required for this.

Conclusion

When deciding between either the ZZP/Eenmanszaak or the BV + 30% ruling setup, there are a lot more factors to consider than the mere tax treatment of both. You are well advised to make a calculated decision, as a transfer to a BV + 30% ruling later is not possible if at first you have chosen the ZZP/Eenmanszaak. It is however possible to transfer to a normal BV setup, but you will not be able to obtain the 30% ruling going forward.