Register new company with the 30% ruling in the Netherlands

Get your quote today!

12+ years experience. Trusted by 100+ clients.

Freelancing in the Netherlands with a 30% ruling

The Netherlands is an ideal place to settle yourself as a self-employed person, contractor or freelancer. If you plan to earn more than € 67,000 per year (2025), it is wise to look into the BV+30% ruling setup.

Use your Dutch BV entity to invoice your clients (anywhere in the world) and earn your income from it with a 30% ruling tax break applied to it

Transferring an existing 30% ruling in 4 steps

Start doing business and earn salary with 30% ruling!

Step 1

Check if you meet the prerequisites for the 30% ruling. If not, we don’t proceed.

Step 2

We register your BV 100% online. The BV will be registered at your residential or office address in the Netherlands.

Step 3

Enter a correct 30% employment agreement as a director with your BV.

Step 4

We make sure your 30% ruling is correctly transferred to your own company.

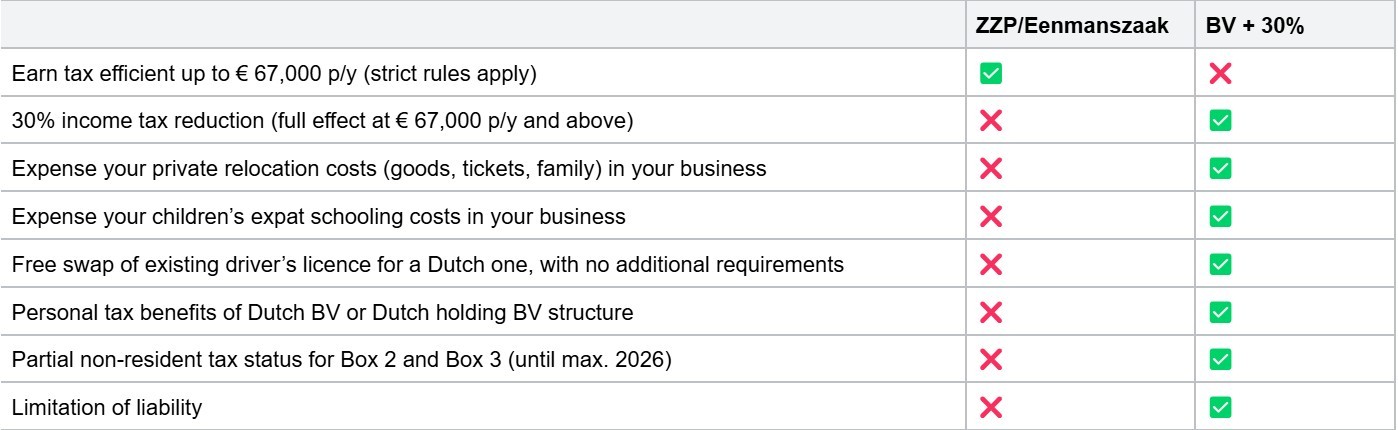

Comparing ZZP/Eenmanszaak with a BV + 30% setup.

FAQs: Register Company with 30% ruling

What is different about the setup of a BV in the 30% ruling package?

In order for the 30% ruling to work, you need to be hired from outside the Netherlands. That means you must incorporate the BV as a foreign shareholder with a foreign address. You must also provide a proof of your foreign address, by way of a utility bill not older than 30 days. This requires additional notarial identification and KYC work, which raises the costs slightly. Check this article for more info.

Can I also use the 30% ruling while freelancing from an Eenmanszaak (Sole Proprietorship) ?

No you cannot. For the 30% you need an employment contract, and you need a BV to provide this for you. The eenmanszaak cannot do this.

What is the maximum period between my previous employment under 30% and my new self employment under 30%?

Your 30% ruling will expire within 3 months after the end of your employment. Make sure you start the application of a new ruling within this period, or you will lose it.

NB: some employments end with a so-called “garden leave”, laid down in a settlement agreement between the employer and the employee. If this is the case, the 3 month period mentioned here gets calculated from the start of your garden leave, not the end of the contractual employment relationship.

Does my passport nationality have any bearing on the 30% ruling?

No, none whatsoever. Your passport nationality is only important for your residence and work permit.

I have a lot of specific questions about the 30% ruling itself. Can you help me out?

Please find our dedicated FAQ page for the 30% ruling here.

I hear it’s more tax efficient to pay myself dividends than salary. Why should I pay myself a salary then?

Onder normal circumstances, paying dividends is more tax efficient than paying salary. But with a 30% ruling, it is much more efficient to pay yourself a salary in stead.

I hear there are requirements for freelancing in the Netherlands such as multiple clients, minimum income. How does this work?

These requirements apply to freelancers working from a ZZP/eenmanszaak, when they want to make use of the tax breaks that apply there. As a BV freelancer, these tax breaks do not apply to you, so neither do these requirements. Another article compares the ZZP/eenmanszaak with the BV+30% setup.

How do I maximize my net income as director and shareholder in my BV?

As a freelancer in your BV you can choose between paying yourself salary, and disbursing dividends. Under the 30% ruling it is generally more favorable to pay yourself salary than dividends. So if you want to estimate your net income from your freelancing under 30%, you only need to calculate your salary, not your dividend.

How can I calculate my salary when freelancing in a BV + 30 % ruling?

We recommend only freelancing from a BV+30% ruling if you earn € 67,000 or more per year(2025). If this is the case, you can calculate your net salary as follows:

1. Take 30% off your salary and consider this as tax free compensation.

2. Run the remaining amount through an online DGA salary calculator.

Then add 1. and 2. together. If you earn € 100,000 per year, you should expect to pay about 28%-30% in taxes.

Can I keep my 30% ruling if I decide to go into regular employment later?

Yes you can. But this requires a new application process, with all requirements (except you’re not required to be hired from abroad). If you don’t use your BV anymore at this point, you can choose to liquidate it.

I am required to pay for setting up my freelancing business before it even exists. I need to pay this from my own pocket. How do I expense this in my BV later on?

You pay the full amount of the invoice + the VAT from your private purse. Once you have the BV up and running, you pay the full amount of the invoice from the BV back to your private bank account. The BV takes the invoice in its accounts as run-op costs, and can reclaim all VAT paid. That leaves you with the expense itself, which you can deduct from your taxable profit in your BV. Again, it is strongly advisable to hire an accountant here to help you out.

As a DGA in my own BV, I need to pay myself a minimum DGA salary of € 56,000 (in 2025). Does this mean my 30% ruling only works over the amount above € 56,000 ?

No. The 30% ruling applies with DGAs to the salary amount over € 46,660 (2025) just like with any other employee. Applying the 30% ruling to a € 56,000 salary would mean that a part is paid out as untaxed compensation under the 30% ruling. This does not mean, however, that you are not meeting the minimum DGA salary requirement at that point. This is because the 30% part of the compensation is also to be considered salary under Dutch tax law, and for the purposes of establishing the minimum DGA salary.

If I already work in the Netherlands under 30% ruling, can I switch to freelancing and keep my 30%?

Yes you can, but this also requires a new application process, with all requirements (except you’re not required to be hired from abroad).

NB: Whenever you transfer an existing 30% ruling, the requirement of “being hired from abroad” is dropped. You only need to keep meeting the salary criterium.

How does the 30% ruling relate to the invoices I send to my clients?

Your BV will be the contractor invoicing your clients. The revenues thus received will be used to pay the BV's business expenses, such as accounting costs, setup costs, computer gear and such. The remainder can be used to pay out a salary to you as a director. This is where the 30% ruling applies.

I already HAVE a 30% ruling. Why would I have to apply for a new one, when freelancing with a 30% ruling?

The 30% ruling is a tax break that applies on an individual employment relationship. This means that, if the employer changes, your existing 30% ruling has no use anymore unless it is transferred to the new employer. This requires a new application.

I want to freelance in the Netherlands as a non-EU immigrant under the HSM visa rules. Can I use the 30% ruling?

Yes you can. If you are in the Netherlands on a Highly Skilled Migrant (HSM) visa, that visa will expire once you go freelance. The HSM is a regular employment visa after all, not a self employment visa. As a non-EU freelancer, your best option to obtain a valid work permit is through your partner: either as a dependent on their HSM or Blue Card visa, or as a partner to them as EU or Dutch citizens. If you think the self employed visa or startup visa is your solution, think again. They are extremely hard to get, to the extent that Cardon & Company doensn't facilitate these.

I am already a Highly Skilled Migrant with a valid sticker in my passport. I can use this to work freelance right?

No you cannot. The HSM visa is a regular employment visa, not a self employment visa. You may end your previous HSM employment with a work permit sticker in your passport, but that permit is not valid anymore once the employment ends. Your employer is obliged to notify the IND of this as well.

I am a Highly Skilled Migrant and switching to the BV+30% ruling setup. Now I have 3 months to arrange my new visa right?

No, you don't. The 3 month grace period only exists for switching from HSM to another HSM employment. That is not the case here. You need to have your new visa in immediate succession with your previous HSM visa, otherwise your 5-year timer towards permanent residency will be reset to zero (you will not be kicked out of the country).