Tax breaks and benefits of DAFT visa in 2025

Jan 14, 2025

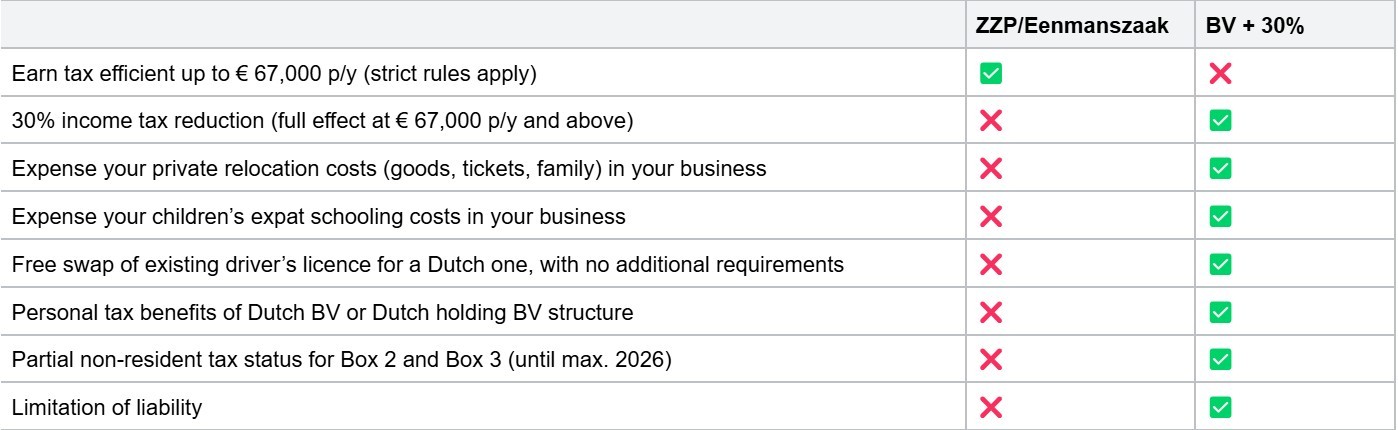

The DAFT visa is an interesting option for Americans with an entrepreneurial spirit and a desire to relocate to the Netherlands. While they are at it, applicants would be wise to look into the tax breaks available. DAFT applicants are faced with the choice between (mainly) two Dutch company types: the BV and the ZZP/Eenmanszaak (same applies to VOF). The choice is usually dictated by the amount of expected revenue, and your eligibility for the fabled 30% ruling. If you earn under € 67,000 per year in your company, the eenmanszaak is usually considered the better option. If you earn more than € 67,000 per year, the BV + 30% is the standard choice. If you are not eligible for the 30% ruling, a sole BV setup becomes more tax efficient than the ZZP/Eenmanszaak around € 120,000 in profits per year. In this case, you can consult another article about the main differences between the Eenmanszaak/ZZP and the BV. You will quickly realize that the biggest tax breaks available to DAFT applicants are only available with a BV + 30% ruling set up. In this article we will explore the biggest tax breaks available, that could make your choice of company type swing in favor of either company form.

NB: As of 2025, the Dutch immigration authorities (IND) have adopted a process of expedited DAFT applications. This means the DAFT final decision is issued about 4-6 weeks after its initial submission!

Relocation cost expensing in your new Dutch company

Dutch employment law allows for Dutch companies to reimburse their employees for their relocation costs, when these relocation costs are incurred as a requirement for the execution of their jobs. Your travels to the Netherlands to begin your work under your labour contract expressly falls under this rule. The costs covered here include: the costs for relocating your household goods, plane tickets for yourself and your direct family members(check this article for family members going along under DAFT). The reimbursement takes place “at cost”. This means you pre-pay the costs beforehand, and you expense them later based on the associated invoices and receipts.

How can you make this work for yourself under DAFT? If you are to set up a Dutch BV, you are going to be employed by it as its director. That makes you subject to the above employment law benefit. This only leaves you the requirement to hire yourself in your company while you are still abroad, so that your relocation to the Netherlands is required as part of the execution of your work for your company. It’s that simple. Just make sure you set up your company and sign your labor contract with your company while still abroad. Coincidentally this is also exactly what is required for the BV + 30% ruling setup.

Availability: This perk is only available when you setup a BV, not an eenmanszaak/ZZP. The 30% ruling is not required for this.

Additional generic relocation cost expensing in your business

The relocation costs mentioned above are reimbursed “at cost”. This means the actual invoices and receipts are being reimbursed. But then there’s an additional benefit, reserved to Dutch employees having to relocate as part of their jobs for Dutch companies: an additional unspecified reimbursement of generic relocation costs up to € 7,750. The Dutch employer is allowed to pay this amount on top of the actual relocation costs incurred by the employee.

How can you make this work for yourself under DAFT? The same as before, make sure you set up your BV and enter into its employment before you move. Then your relocation to the Netherlands is subject to the additional generic relocation cost reimbursement, which means you can expense an amount of up to € 7,750 in your Dutch company.

Availability: This perk is only available when you setup a BV, not an eenmanszaak/ZZP. The 30% ruling is not required for this.

Expense schooling costs in your Dutch company

The previous two tax breaks are available to all employees of Dutch companies. This one is specifically available if you also enjoy the 30% ruling. Under Dutch tax law, the 30% ruling allows employers to reimburse their employees for their respective children’s schooling costs in the Netherlands. The condition here is that the schooling takes place at an expat school in the Netherlands, and that the reimbursement takes place “at cost”, substantiated with invoices and/or receipts.

Availability: This perk is only available if you have a BV and a 30% ruling, not in any other kind of setup.

Free driver’s license swap

As if this is not enough in terms of perks, holders of the 30% ruling are also allowed to swap their foreign driver’s licence for a Dutch driver’s licence. Without any hassle or additional requirements. You just need to make an appointment at your Dutch municipality, present your 30% ruling and your foreign driver’s licence, and all will be arranged.

Availability: This perk is only available if you have a BV and a 30% ruling, not in any other kind of setup.

30% tax break for 30% holders

And then of course there’s the obvious one : if you have the 30% ruling, you can get up to 30% of your income tax free as reimbursement of your so-called extraterritorial expenses in the Netherlands. This one has an income threshold of € 46,660 per year. This threshold means two things :

(1) You can only get the 30% ruling if you meet this minimum annual income

(2) The 30% tax break only applies on all amounts earned above the threshold, not below it.

This means that you need an income of about € 67,000 (€ 66,657 to be exact) in order to fully reap the benefits of the 30% ruling. You can calculate the minimum effective salary by dividing the 30% minimum threshold by 0,7. At this amount, you are able to receive 30% of your salary tax free, and still have an amount of € 46,660 left to meet the threshold. We have a separate article explaining the process of obtaining DAFT, BV and 30% ruling all in one.

Availability: This perk is only available if you have a BV and a 30% ruling, not in any other kind of setup.

Partial non-Residence tax status

When you are living and working in the Netherlands, of course you need to declare and pay taxes over your income. In the Netherlands this is called “BOX 1 taxation”. This is where the 30% income tax break applies, among other things. But there is also a BOX 2 and a BOX 3 taxation. BOX 2 is a taxation on any major shareholdings (> 5%) you may have going on. BOX 3 is a taxation on liquid assets, crypto, savings, minor shareholdings (< 5%) and such.

When you file your tax returns in the Netherlands, you need to declare all your income (BOX 1 to 3) from anywhere in the world. This is where the specter of double-taxation looms for expats. But declaring income doesn’t automatically mean you need to pay taxes over it. You are usually covered by the double-taxation treaties between the Netherlands and the source country of the foreign income. That being said, if the source country has a much lower tax rate than the Netherlands on a particular source of income, the Netherlands Tax Authorities may reserve the right to tax the difference between these two tax rates.

Holders of a 30% ruling may choose for a partial non-resident tax status for their BOX 2 and BOX 3 taxation during their annual income tax returns. Having a partial non-residence tax status is a safe pair of hands when it comes to taxation on your foreign assets. The partial non-resident status means the Netherlands will keep its hands off any foreign BOX 2 and BOX 3 income you may have, while being a tax resident in the Netherlands. NB: if you obtain and apply a 30% ruling from January 1st, 2024 and onwards, the partial non-resident tax status gets abolished per January 1st, 2025. If you have obtained and applied a 30% ruling before January 1st, 2024 you will be able to use the partial non-resident tax status up until December 31st, 2026. As of January 1st, 2027 the partial non-resident tax status will be completely abolished for everyone.

Availability: This perk is only available if you have a BV and a 30% ruling, not in any other kind of setup.

Visualization of the tax breaks and benefits available per company form

General rules for cost expensing in your Dutch company

And finally there are the general options for expensing business costs in your Dutch company. As a rule, you can expense any cost in your business that was required to further the interests of your business. If you feel like expensing an incurred cost in your business, be prepared to explain why you incurred that cost for your business, and to what benefit. Costs can pertain to a lot of things, including these:

- Business setup and registration costs;

- Costs for legal, tax and business advice preceding your business setup;

- Business lunches, dinners and drinks;

- Study trips, business travels, seminars, congresses;

- Business phone subscription;

- Travel expenses with own transportation : €0,23 per kilometer (2025);

- Devices required for work (telephone, laptop);

- (Liability) Insurance premiums;

- Office lease contract;

- Office utensils (paper, printer, ink etc.);

- Business literature;

These costs cannot all be expensed for 100% and not in all cases can VAT be reclaimed. Please consult your accountant. If you don’t have an accountant, you can book a meeting with an affordable one via here. In a separate article, we have explained what you can expect in terms of administration, tax and accounting in the first year of your BV.

Availability: Al commercial companies (ZZP/Eenmanszaak and BV alike)